operating cash flow ratio importance

Put another way it shows how efficient or inefficient your company is at. Operating cash flow ratio is an important measure of a companys liquidity ie.

Free Cash Flow Conversion Fcf Formula And Example Analysis

A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate.

. The operating cash flow ratio and current ratio can both be used to determine the ability of an organization to pay its current obligations. High cash flow from operations ratio indicates better liquidity position of the firm. However they have current liabilities of 120000.

Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you make. Below is an example of operating cash flow OCF using Amazons 2017 annual report. Its a measure of how much money you are generating from your operations per every dollar in sales you bring in.

This ratio is similar to the cash ratio. Operating cash flow OCF ratio. In accounting it is a measure for amount of cash generated by a companys normal business operations.

High Low Operating Cash Flow Ratio. This means that Company A earns 208 from operating activities per every 1 of current liabilities. Essentially Company A can cover their current liabilities 208x over.

The Operating Cash Flow Margin also called the Cash Flow Margin or simply the Margin Ratio is one of the most commonly used profitability ratios. Without positive cash flow a company doesnt have as much flexibility. Operating cash flow ratio.

So we can see that Radha succeeded in generating 55000 of cash flows from her operations. The operating cash flow ratio is a measure of a companys liquidity. Operating Cash Flow 55000.

We use the cash flow ratio to determine the companys overall financial performance. A higher level of cash flow indicates a better ability to withstand declines in operating performance as well as a better ability to pay dividends to investors. The higher the number is the more your business is making.

The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations. They are an essential element of any analysis that seeks to understand the liquidity of a. Your business friend is on its way out unless you can manage your cash flow.

Its ability to pay off short-term financial obligations. When you have negative cash flow you arent making enough money to cover the cost of your operations. Cash is what keeps businesses running and a high operating cash flow is an.

Operating Cash Flow Net Income - Changes in Assets and Liabilities Non-Cash Expenses. The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded. So a ratio of 1 above is within the desirable range.

Operating cash flow is a measurement of a businesss cash flow and uses and is the best indicator of business profitability. When performing financial analysis operating cash flow should be used in conjunction with net income free cash flow FCF and other metrics to properly assess a companys performance and financial health. Why are cash flow ratios important.

This may signal a need for more capital. Here is the formula for calculating the operating cash flow ratio. Operating cash flow is important because it indicates whether a company is able to generate sufficient positive cash flow to maintain and grow its operations or whether it may require external financing.

The numerator of the OCF ratio consists of net cash. Having a negative cash flow is acceptable at times but should not become a habit. What is Operating Cash Flow Ratio OCF.

A ratio smaller than 10 means that your business spends more than it makes from operations. Over time a businesss cash flow ratio amount should increase as it demonstrates financial growth. Operating Cash Flow Ratio.

It should be considered together with other liquidity ratios such as current ratio quick ratio cash ratio etc. It demonstrates the changes in working capital such as receivables and inventory and removes the many of the opportunities for manipulation. This ratio is generally accepted as being more reliable than the priceearnings ratio as it is harder for false internal adjustments to be made.

They may have to borrow money or in the worst case go out of business. Operating cash flow Net cash from operations Current liabilities. The operating cash flow.

The Operating Cash Flow Ratio a liquidity ratio is a measure of how well a company can pay off its current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due and payable within a year. As you can see the. Cash flow ratios compare cash flows to other elements of an entitys financial statements.

Operating cash flow measures cash generated by a companys business operations. 250000 120000 208. 100000 50000 20000 25000 10000.

Operating cash flow ratio is calculated by dividing the cash flow from operations. When you have positive cash flow youre making enough money to cover your bills and even reinvest in your business expanding operations and hiring new employees. Lets calculate Radhas store by using the indirect method.

However we do not use the most liquid money and assets currently held by the company. There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations. An auditor relying solely on the quick and current ratios in this instance would have missed that important point.

Operating Cash Flow Example. We can use several ratios to learn more about company finances. It is important to understand cash flow from operations also called operating cash flow.

The operating cash flow ratio assumes that cash flows from operations will be the source of funds for those payments while the current. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities. You can work out the operating cash flow ratio like so.

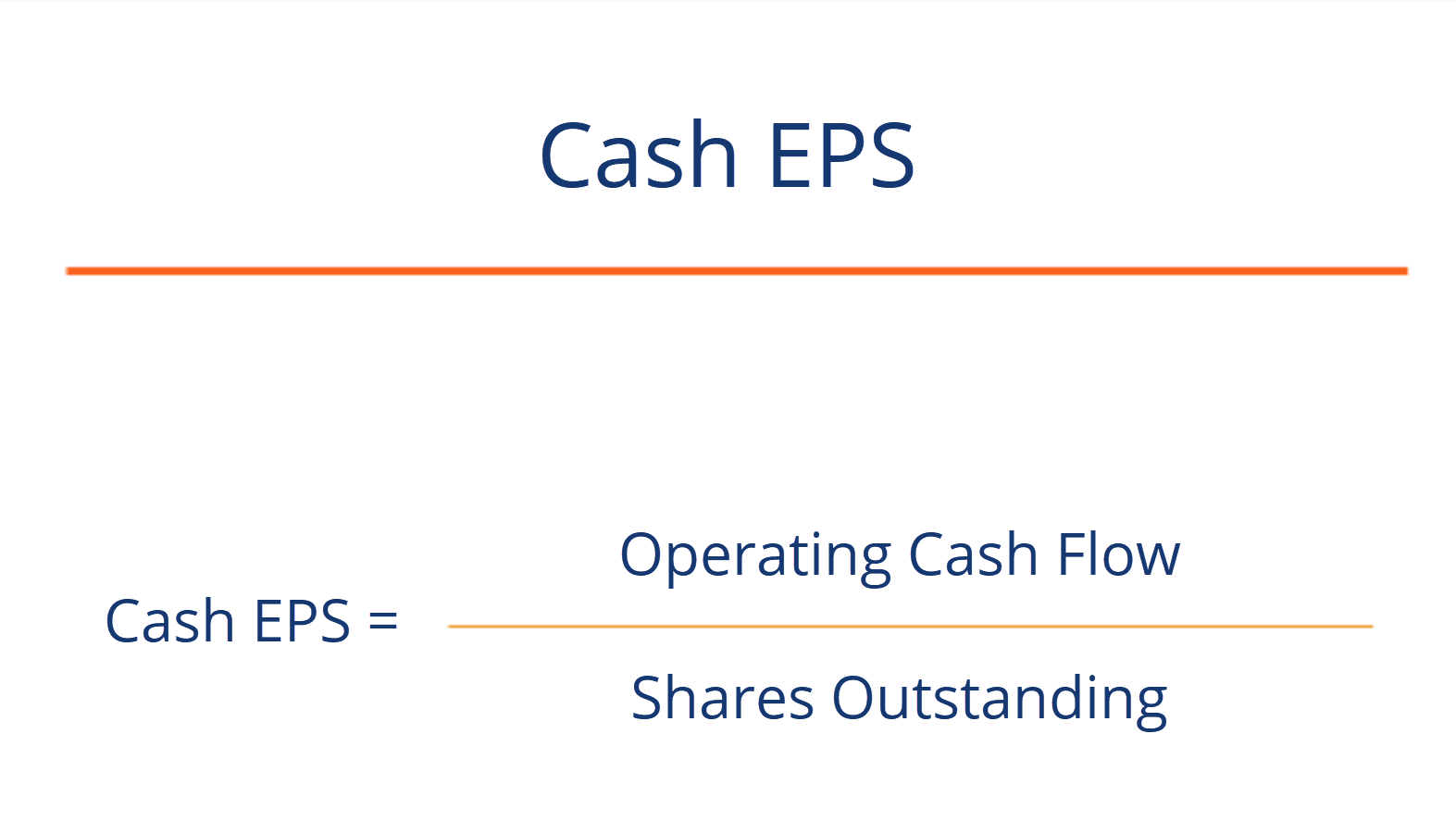

However there is a crucial difference between the two measures. It measures the amount of operating cash flow generated per share of stock. Thus investors and analysts typically prefer higher operating cash flow ratios.

Cash flow and OCF is what helps companies expand launch new products pay dividends and even reduce debt. An auditor who bothered to calculate two other cash flow ratiosFFC and cashcurrent debtwould have gotten even more remarkable results. Free cash flow is the cash that a company generates from its business operations after subtracting.

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow Formula Calculator Excel Template

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Fcf Formula Formula For Free Cash Flow Examples And Guide

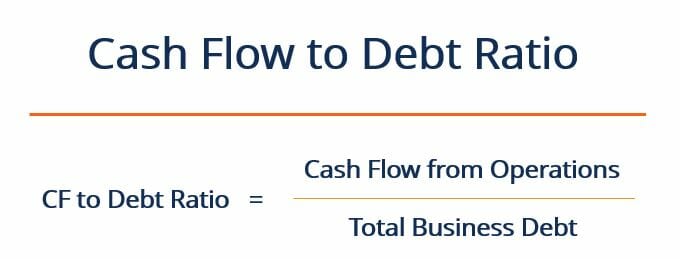

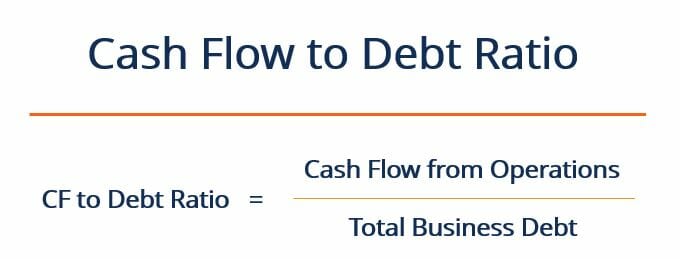

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Operating Cash Flow Definition Formula And Examples

Operating Cash Flow Ratio Definition Formula Example

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Eps Operating Cash Flow Divided By Shares Outstanding

Cash Flow Per Share Formula Example How To Calculate

Operating Cash Flow Ratio Calculator

Cash Flow From Operating Activities Direct And Indirect Method Efm

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)